Drive Smart: Affordable Lease Offers Wethersfield for every single Budget plan

Wiki Article

The Ins and Outs of Cars and truck Leasing: A Comprehensive Guide on Just How It Works

Browsing the world of car leasing can be a complicated undertaking, requiring a solid grip of the complexities entailed. From recognizing lease terms to computing payments and exploring end-of-lease options, there are countless aspects to think about when pondering this financial commitment. As customers significantly select leasing over typical automobile ownership, it comes to be vital to decipher the nuances of this procedure to make enlightened decisions. In this extensive overview, we will certainly study the core components of car leasing, clarifying the mechanisms that drive this popular lorry purchase approach.Benefits of Car Leasing

When taking into consideration the benefits of auto leasing, it is important to evaluate the monetary advantages that include this alternative. One significant benefit is the reduced regular monthly settlements related to leasing compared to acquiring a vehicle. Leasing allows people to drive a more recent vehicle with reduced ahead of time costs and lower month-to-month payments considering that they are just funding the lorry's devaluation throughout the lease term, as opposed to the entire purchase cost. This can be specifically appealing for people who like to update to more recent models often.

In addition, car leasing frequently includes guarantee protection throughout of the lease, providing comfort against unexpected repair costs. Because leased automobiles are generally under the producer's guarantee throughout the lease term, lessees can prevent the monetary worry of significant fixings. In addition, leasing might offer tax benefits for local business owner that use the vehicle for business purposes, as lease payments can often be subtracted as an overhead. Generally, the monetary benefits of auto leasing make it an engaging option for lots of customers.

Comprehending Lease Terms

Taking into consideration the financial advantages of auto leasing, it is critical to understand the details of lease terms to make informed choices concerning this car funding option. Lease terms refer to the particular problems described in the leasing arrangement between the lessee (the person renting the vehicle) and the lessor (the renting business) These terms commonly include the lease duration, month-to-month payment amount, gas mileage restrictions, deterioration standards, and any prospective costs or penalties.

Calculating Lease Repayments

Exploring the procedure of calculating lease payments loses light on necessary monetary considerations for people involving in automobile leasing agreements. Lease settlements are usually determined by taking into consideration aspects such as the vehicle's devaluation, the agreed-upon lease term, the money aspect (interest price), and any type of added charges. To compute lease repayments, one can use the following formula: Month-to-month Lease Repayment = (Devaluation + Finance Cost) ÷ Number of Months in the Lease Term.Maintenance and Insurance Considerations

Recognizing the maintenance and insurance demands connected with automobile leasing is crucial for lessees to make sure the correct treatment and protection of the vehicle throughout the lease term. Upkeep duties vary amongst leasing arrangements, however lessees are typically anticipated to support the supplier's recommended maintenance routine. Failing to do so about his can result in charges at the end of the lease or gap certain service warranties. When essential., lessees need to maintain detailed documents of all maintenance and repair work to supply evidence of compliance.Concerning insurance coverage, all rented lorries must have detailed and crash protection with liability limits that fulfill or go beyond the renting business's requirements. This is to secure both the lessee and the renting firm in instance of a mishap or damages to the automobile. It is necessary to carefully evaluate the insurance coverage demands detailed in the lease arrangement and make sure that the coverage is preserved throughout the lease term. Failure to preserve read the full info here adequate insurance coverage can lead to major repercussions, consisting of possible monetary obligations and legal problems. By satisfying these upkeep and understanding and insurance obligations, lessees can enjoy a smooth leasing experience while guarding the leased automobile.

End-of-Lease Options and Process

As completion of the lease term methods, lessees are offered with various choices and a specified procedure for choosing or returning the car to seek a different setup. One common option is to simply return the automobile to the owner at the end of the lease term. Lessees are normally in charge of any excess gas mileage charges, deterioration costs, and any kind of various other outstanding payments as outlined in the lease contract.

Another option for lessees is to trade in the leased car for a brand-new lease or purchase. This can be a hassle-free alternative for those who prefer to constantly drive a new lorry without the headache of selling or returning the existing rented vehicle.

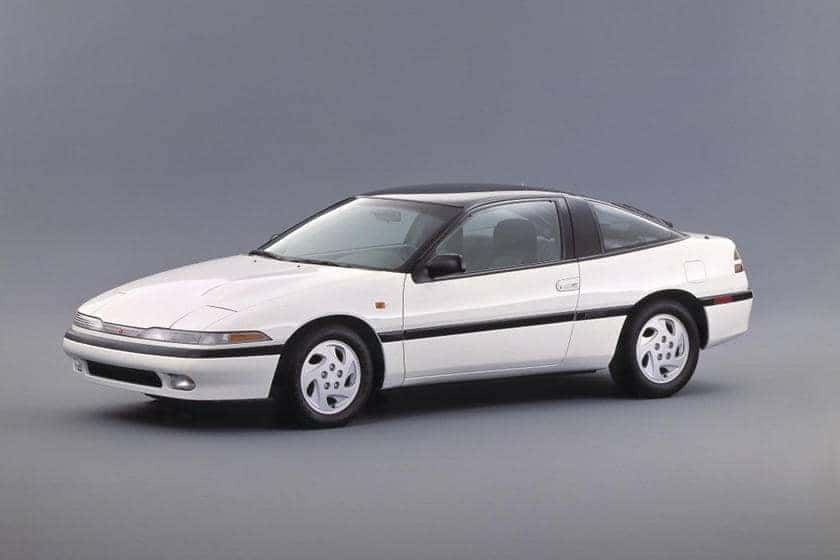

Ultimately, understanding the end-of-lease alternatives and process is vital for lessees to make educated choices that line up with their requirements and preferences. Mitsubishi Outlander lease deals bristol.

Final Thought

In verdict, automobile leasing supplies benefits such as reduced monthly repayments and the ability to drive a new automobile every few years. Recognizing lease terms, calculating repayments, and taking into consideration upkeep and insurance coverage are essential aspects of the leasing process. Furthermore, recognizing the end-of-lease choices and procedure is important for a smooth transition at the end of the lease term. On the whole, auto leasing can be a sensible choice for those looking for flexibility and reduced prices in vehicle ownership.Considering that leased lorries are typically under the producer's guarantee during the lease term, lessees can prevent the financial burden of major repairs. Lease terms refer to the particular conditions outlined in the leasing agreement between the lessee (the individual renting the automobile) and the owner (the leasing firm)One essential facet of lease terms is the lease duration, which is the length of time the lessee agrees to rent the automobile. New Mitsubishi her comment is here lease specials Windsor. Lease settlements are normally established by considering elements such as the vehicle's depreciation, the agreed-upon lease term, the money variable (interest price), and any kind of additional charges. To compute lease payments, one can utilize the complying with formula: Monthly Lease Settlement = (Devaluation + Money Charge) ÷ Number of Months in the Lease Term

Report this wiki page